Introduction to Cross Country Mortgage

Who is Cross Country Mortgage Login?

Cross Country Mortgage is a prominent and reliable mortgage lender that has been assisting homeowners across the United States with their home financing needs. With an unwavering commitment to providing exceptional service, this organization offers a plethora of mortgage options tailored to suit individual requirements.

The benefits of a Cross Country Mortgage account

Having a Cross Country Mortgage account opens up an array of advantages, including competitive interest rates, flexible loan terms, and access to a user-friendly online platform for managing mortgage payments and tracking the loan’s progress.

Setting Up Your Cross Country Mortgage Account

How to apply for a mortgage with Cross Country

Embarking on your journey with Cross Country Mortgage starts with a simple online application process. Visit their website, fill out the necessary information, and submit your application. A dedicated loan officer will then contact you to discuss your mortgage options and guide you through the process.

Required documents for account setup

To expedite the account setup process, have the following documents ready: proof of income, employment history, bank statements, credit report, and other relevant financial documents.

Navigating the account creation process

After submitting your application and providing the necessary documentation, Cross Country Mortgage’s team of underwriters will review your financial standing. Upon approval, you will receive your login credentials and be guided through the account creation process, ensuring a seamless experience.

Logging into Your Cross Country Mortgage Account

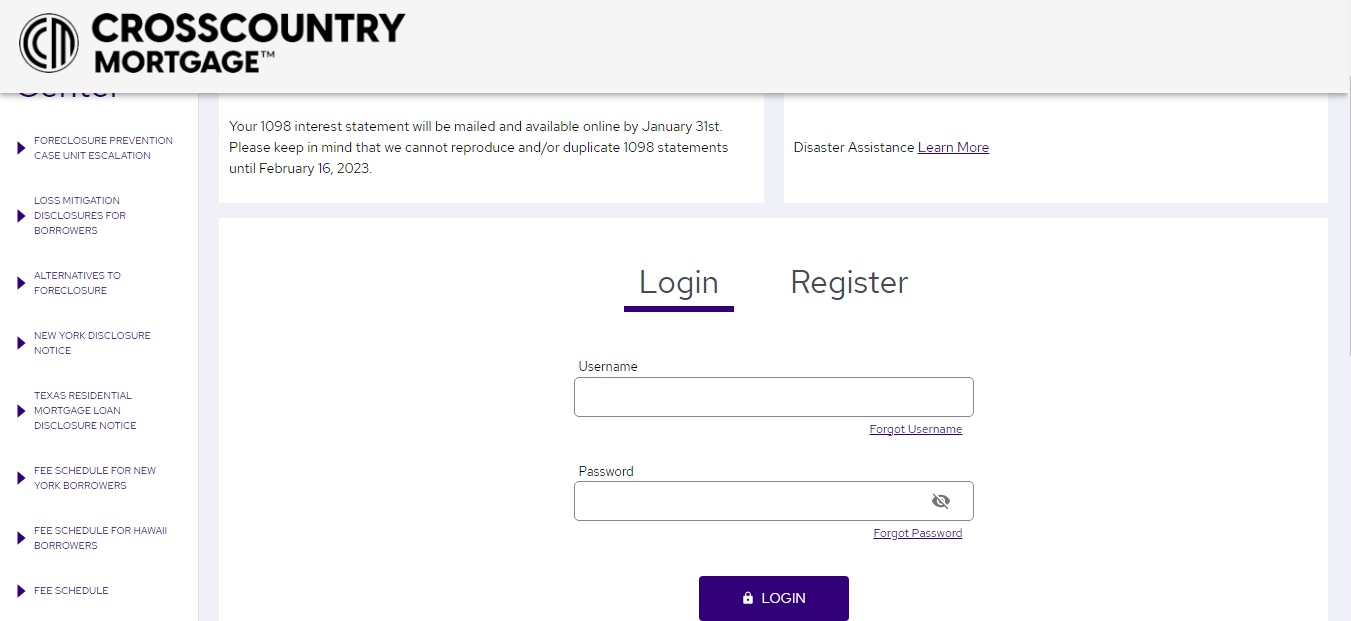

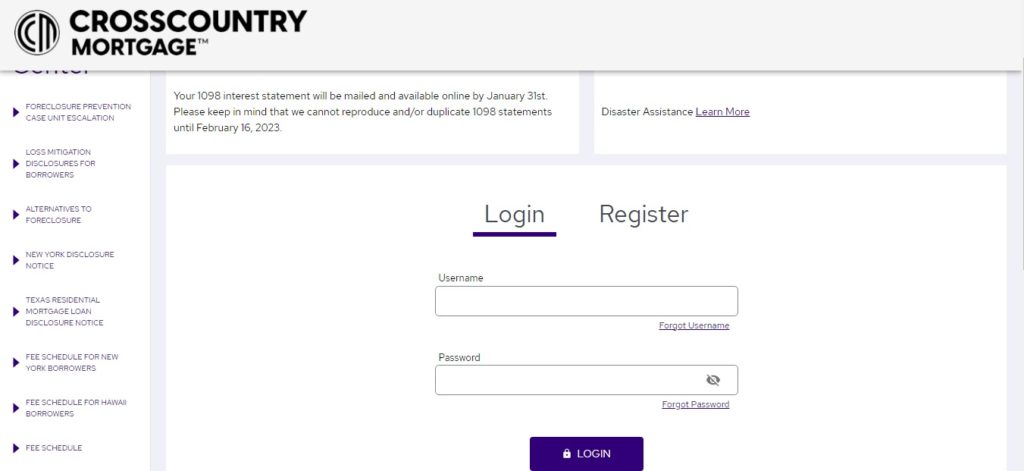

How to access the login page

To access the Cross Country Mortgage login page, visit their official website and click on the “Sign In” button located on the top right corner. Enter your username and password, and then click “Login” to access your account.

Troubleshooting common login issues

Should you encounter any login difficulties, try resetting your password or clearing your browser’s cache and cookies. If the issue persists, contact the customer support team for further assistance.

Retrieving your username or password

In the event you forget your username or password, click the “Forgot Username/Password?” link on the login page. Follow the prompts to recover your login credentials.

Account Dashboard Features

Overview of the account dashboard

The account dashboard offers a comprehensive snapshot of your mortgage account, including your loan balance, interest rate, and remaining term. This user-friendly interface also provides easy access to various account management tools.

Understanding your mortgage details

Your mortgage details include crucial information such as the loan type, repayment schedule, and any applicable fees. Familiarizing yourself with these details enables you to make informed decisions regarding your mortgage.

Accessing payment history and statements

To review your payment history and access mortgage statements, navigate to the “Payments” or “Statements” section within your Cross Country Mortgage login account dashboard.

Making Mortgage Payments

How to make an online payment

To make an online payment, log in to your Cross Country Mortgage login account and select the “Make a Payment” option. Enter the desired payment amount and your banking information, then submit your payment securely.

Scheduling automatic payments

Set up automatic payments by visiting the “Payments” section of your account and selecting the “Auto Pay” option. Input your payment preferences and banking information, and enjoy the convenience of automated mortgage payments.

Paying through other methods

Cross Country Mortgage login also accepts payments via mail, phone, or wire transfer. Consult their customer support for more information on these payment methods.

Managing Your Mortgage Account

Updating personal information

To update your personal information, log in to your account and visit the “Profile” section. Make the necessary changes and save your updated information.

Changing your password and security settings

For enhanced security, periodically update your password by visiting the “Profile” section and selecting “Change Password” in Cross Country Mortgage login account. Follow the prompts to create a new, secure password.

Adding or removing authorized users

To add or remove authorized users, navigate to the “Profile” section and select “Manage Authorized Users.” Add or remove users as needed, ensuring that only trusted individuals have access to your mortgage account.

Refinancing with Cross Country Mortgage

When should you consider refinancing?

Refinancing may be a viable option if you’re looking to lower your interest rate, reduce your monthly payment, or switch from an adjustable-rate to a fixed-rate mortgage. Consider refinancing when market conditions are favorable and you have a strong credit profile.

The refinancing process

The refinancing process with Cross Country Mortgage mirrors the initial application process. Submit an application, provide the required documentation, and work with a loan officer to determine the most suitable refinancing option for your needs.

Tips for a smooth refinancing experience

To ensure a seamless refinancing experience, maintain open communication with your loan officer, promptly provide requested documentation, and monitor market conditions to time your refinancing optimally.

Loan Modification and Assistance Programs

What is a loan modification?

A loan modification involves adjusting the terms of your existing mortgage to make payments more manageable. This may include lowering the interest rate, extending the loan term, or deferring a portion of the principal balance.

Qualifying for assistance programs

Cross Country Mortgage offers various assistance programs to eligible borrowers facing financial hardship. To qualify, contact their customer support team and provide information about your financial situation and the specific challenges you’re experiencing.

Steps to apply for a loan modification

To apply for a loan modification, reach out to Cross Country Mortgage’s customer support team. They will guide you through the application process, assess your eligibility, and provide tailored solutions to address your financial challenges.

Cross Country Mortgage Mobile App

How to download and set up the app

The Cross Country Mortgage mobile app is available on both Android and iOS devices. Download the app from the respective app store, install it, and log in with your existing account credentials.

App features and benefits

The mobile app offers a convenient way to manage your mortgage on the go. Features include making payments, tracking your loan progress, accessing mortgage statements, and receiving account notifications.

Paying your mortgage through the app

To make a payment through the mobile app, navigate to the “Payments” section, enter the payment amount, and submit your payment securely.

Frequently Asked Questions

Common questions about Cross Country Mortgage

Typical questions about Cross Country Mortgage encompass topics such as loan types, interest rates, eligibility criteria, and the application process. Consult their website or contact customer support for answers to your specific queries.

Tips for first-time homebuyers

First-time homebuyers should research mortgage options, maintain a strong credit score, save for a down payment, and work with a reputable lender like Cross Country Mortgage to ensure a successful home buying experience.

Addressing credit score concerns

To improve your credit score, pay your bills on time, reduce outstanding debt, maintain a low credit utilization rate, and regularly review your credit report for inaccuracies.

How do I apply for a mortgage with Cross Country Mortgage?

Visit the Cross Country Mortgage website, fill out the online application with the necessary information, and submit it. A loan officer will then contact you to discuss your mortgage options and guide you through the process.

How can I access my Cross Country Mortgage Login account?

To access your account, visit the Cross Country Mortgage website, click on the “Sign In” button on the top right corner, and enter your username and password. If you encounter any login difficulties, try resetting your password or contacting customer support for assistance.

What are the different ways to make mortgage payments with Cross Country Mortgage?

You can make mortgage payments through the online account dashboard, the mobile app, by mail, phone, or wire transfer. To set up automatic payments, visit the “Payments” section of your account and select the “Auto Pay” option.

How do I refinance my mortgage with Cross Country Mortgage?

The refinancing process is similar to the initial application process. Submit an application, provide the required documentation, and work with a loan officer to determine the most suitable refinancing option based on your needs and financial situation.

How can I apply for a loan modification or assistance program with Cross Country Mortgage?

To apply for a loan modification or assistance program, contact Cross Country Mortgage’s customer support team. They will guide you through the application process, assess your eligibility, and provide tailored solutions to address your financial challenges.

Customer Support Options

Contacting Cross Country Mortgage

Reach out to Cross Country Mortgage’s customer support team via phone, email, or online chat to address your concerns or seek assistance.

Using the online chat feature

The online chat feature, accessible on the Cross Country Mortgage website, offers real-time support from knowledgeable representatives to help answer your questions and resolve issues.

Accessing helpful resources

Cross Country Mortgage’s website features a wealth of resources, including mortgage calculators, informative blog articles, and answers to frequently asked questions, to assist borrowers in making informed decisions.

Closing Your Cross Country Mortgage Account

When to consider closing your account

Closing your mortgage account may be appropriate when you’ve paid off your mortgage, sold your property, or refinanced with another lender.

Steps to close your mortgage account

To close your mortgage account, contact Cross Country Mortgage’s customer support team, who will guide you through the necessary steps and ensure a smooth closure process.

Handling remaining mortgage balance

If you have a remaining mortgage balance upon closing your account, you will need to either pay off the balance in full or refinance with another lender. Consult with a financial advisor to determine the best course of action for your specific situation.

Final Thoughts

Recap of Cross Country Mortgage login and account management

In summary, Cross Country Mortgage login offers a user-friendly platform for managing your mortgage, with easy access to account information, payment options, and personalized support. Their website and mobile app make managing your mortgage a convenient and seamless experience.

Ensuring a successful mortgage journey with Cross Country

By staying informed, maintaining open communication with your loan officer, and utilizing the wealth of resources provided by Cross Country Mortgage, you can navigate the mortgage process with confidence and achieve a successful homeownership journey.